Global demand and supply for agricultural products and fruits is projected to continue increasing in 2024 due to rising consumption across regions. In terms of trade, the largest gainers in 2023 were rice, and sugar in the agricultural category, and apples, berries, pears, grapes, mangoes, melons, and bananas in the fruit category. This research report covers detailed data on imports and exports of agricultural products and fruits.

World Agricultural Demand and Supply by Commodity

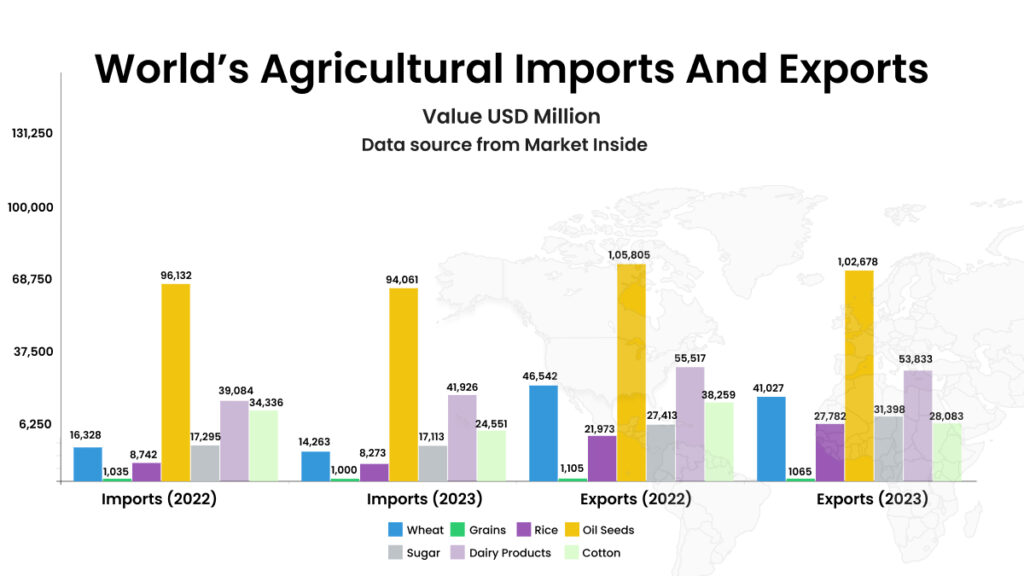

Global trade of agricultural commodities is expected to increase in 2024 due to rising consumption of foods products. Oil seeds are imported and exported the most among agricultural products in 2023, followed by dairy products, wheat, sugar, and cotton. Below given chart shows global imports and exports of major agricultural commodities – wheat, grains, rice, oil seeds, sugar, dairy products, and cotton.

| Commodity | Imports (2022) | Imports (2023) | Exports (2022) | Exports (2023) |

| Wheat | 16,328 | 14,263 | 46,542 | 41,027 |

| Grains | 1035 | 1000 | 1105 | 1065 |

| Rice | 8,742 | 8,273 | 21,973 | 27,782 |

| Oil Seeds | 96,132 | 94,061 | 1,05,805 | 1,02,678 |

| Sugar | 17,295 | 17,113 | 27,413 | 31,398 |

| Dairy Products | 39,084 | 41,926 | 55,517 | 53,833 |

| Cotton | 34,336 | 24,551 | 38,259 | 28,083 |

*****Data of Top 5 Countries of Each Commodity: Indonesia, China, Turkey, Italy, Philippines, United States, Netherlands, Germany, Mexico, Canada, Chile, Australia, Iran, Saudi Arabia, Japan, United Kingdom, France, Belgium, New Zealand, Bangladesh, Vietnam, India, Brazil, and Pakistan

Wheat

Global wheat production for 2024/25 is forecasted at 798 million tons, up 11 million tons from the previous year. Production in North America is set to recover; however, Europe and the Black Sea region may record lower values. Global wheat consumption is projected at 800 million tons in 2024, up 2 million tons from last year.

The global wheat outlook is for record production and consumption, however, lower trade and contracting ending stocks. Production is projected to rise with larger crops in India, China, Australia, Kazakhstan, Canada, Pakistan, and the United States more than offsetting declines for the European Union, Ukraine, Russia, and the United Kingdom. Global trade will come with less demand from the European Union and Pakistan. Exports are forecasted to decline, particularly for Ukraine.

Here’s a list of the world’s top 5 importers and exporters of wheat and their projections and reasons for the change in the values.

| World’s Top Importers of Wheat (Forecast) | |||||

| Country | Attribute | 2023/24 (1,000 MT) | 2024/25 (1,000 MT) | Y-Y Change (1,000 MT) | |

| Egypt | Imports | 11,000 | 12,000 | 1,000 | |

| Indonesia | Imports | 12,000 | 11,500 | -500 | |

| China | Imports | 11,500 | 11,000 | -500 | |

| European Union | Imports | 13,500 | 11,000 | -2,500 | |

| Turkey | Imports | 9,500 | 10,500 | 1,000 | |

| World’s Top Exporters of Wheat (Forecast) | |||||

| Russia | Exports | 53,500 | 52,000 | -1,500 | |

| European Union | Exports | 35,000 | 34,000 | -1,000 | |

| Canada | Exports | 24,000 | 24,500 | 500 | |

| Australia | Exports | 24,500 | 22,000 | -2,500 | |

| United States | Exports | 19,500 | 21,000 | 1,500 | |

Coarse Grains

Global coarse grain production is forecasted at a record high as larger production of millet, barley, sorghum, oats, mixed grains, and rye more than offset a decline in corn. Coarse grain production in Brazil, China, and the European Union is likely to increase, while Argentina, Ukraine, and the United States may slow down in 2024.

The global consumption of coarse grain is anticipated to grow, primarily on higher feed consumption. In the Middle East and North Africa, corn imports are forecasted to grow by 2 and 6 percent respectively to a total of 37 million tons in 2024-25.

Corn exports from the United States is expected to go down, Brazil’s corn exports to remain unchanged, Argentina’s corn exports to go up, and Ukraine’s corn exports to decline in the said period. Check the list of importers and exporters of coarse grains in the world with projected values.

| World’s Top Importers of Coarse Grain (Forecast) | ||||||

| Country | Attribute | Commodity | 2024 (1,000 MT) | 2025 (1,000 MT) | Y-Y Change (1,000 MT) | |

| China | Imports | Barley Corn Sorghum | 10,200 23,000 7,500 | 10,000 23,000 8,000 | -200 0 500 | |

| Egypt | Imports | Corn | 7,500 | 8,000 | 500 | |

| European Union | Imports | Corn | 21,000 | 18,000 | -3,000 | |

| Iran | Imports | Corn | 8,600 | 9,000 | 400 | |

| Japan | Imports | Corn | 15,500 | 15,500 | 0 | |

| World’s Top Exporters of Coarse Grain (Forecast) | ||||||

| Country | Attribute | Commodity | 2024 (1,000 MT) | 2025 (1,000 MT) | Y-Y Change (1,000 MT) | |

| Argentina | Exports | Barley Corn | 3,200 36,000 | 3,500 37,000 | 300 1,000 | |

| Australia | Exports | Barley Sorghum | 7,000 1,400 | 5,400 1,900 | -1,600 500 | |

| Brazil | Exports | Corn | 51,000 | 51,000 | 0 | |

| Canada | Exports | Barley | 2,300 | 2,400 | 100 | |

| European Union | Exports | Barley | 6,200 | 7,500 | 1,300 | |

Rice

Global rice production is projected to reach 527 million tons in 2024 from 10 million tons recorded a year earlier. India is expected to make a new record, followed by China. Together these two producers account for more than half of global rice production.

World rice consumption is up 4 million tons to a record 526 million tons. India, the second-largest consuming country of rice is projected to reach a record high at 120 million tons. Whereas, China, the world’s largest consuming country of rice is projected to decline for a third consecutive year.

Global rice production is forecasted at a record with larger production in Asia, especially on record crops in Bangladesh, India, and Pakistan, along with improved crops in China. Global consumption of rice is expected to increase and reach a new high, primarily from strong growth in Bangladesh, India, and the Philippines. India is forecasted to remain the top exporter of rice in the world in 2024 despite ongoing trade restrictions.

Indonesia is forecasted to record a decline in rice imports from 2 million tons to 1.5 million tons in 2025 due to a larger crop and sufficient beginning stocks. India is forecasted to remain the largest rice exporter in 2025 with exports projected at 18 million tons, up 1.5 million tons from the previous year and accounting for over a third of global rice trade. Here is a list of global importers and exporters of rice with a change in trade is expected in 2024.

| World’s Top Importers of Rice (Forecast) | |||||

| Country | Attribute | 2024 (1,000 MT) | 2025 (1,000 MT) | Y-Y Change (1,000 MT) | |

| Philippines | Imports | 4,100 | 4,200 | 100 | |

| Vietnam | Imports | 2,750 | 2,950 | 200 | |

| European Union | Imports | 2,200 | 2,200 | 0 | |

| Nigeria | Imports | 2,000 | 2,000 | 0 | |

| Iraq | Imports | 2,000 | 1,900 | -100 | |

| World’s Top Exporters of Rice (Forecast) | |||||

| India | Exports | 16,500 | 18,000 | 1,500 | |

| Vietnam | Exports | 8,000 | 7,500 | -500 | |

| Thailand | Exports | 8,400 | 7,500 | -900 | |

| Pakistan | Exports | 5,500 | 5,200 | -300 | |

| United States | Exports | 3,075 | 3,200 | 125 | |

Oil Seeds

Global oilseed production in 2024-25 is forecasted at a new record of 687 million tons, up 4% as compared to the previous period. This boost is driven by higher soybean output in South America and the United States. According to a report, world soybean production is likely to increase by over 25 million tons and rapeseed production may remain unchanged as grains in Australia, Canada, and China are forecasted to offset declines in the European Union, India, and Ukraine.

World consumption of oilseed is expected to increase 3% in 2024-25, driven by soybean crush recovery in Argentina, growing feed demand in China, as well as increasing demand for soybean oil in the United States. Global oilseed trade is forecasted to be up 4% with higher soybean and rapeseed demand more than offsetting lower sunflower seed imports. Below given table shows country-wise 2023-24 outlook changes of oilseed exports and imports and reasons for change.

| World’s Top Importers and Exporters of Oilseed (2023-24 Outlook Changes) | ||||||

| Country | Commodity | Attribute | Previous | Current | Change | |

| Argentina | Oilseed, Soybean | Imports | 6,100 | 6,500 | 400 | |

| Brazil | Meal, Soybean Oilseed, Soybean | Exports Exports | 20,600 103,000 | 21,100 102,000 | 500 -1,000 | |

| Canada | Oilseeds, Rapeseed | Exports | 7,250 | 6,550 | -700 | |

| Egypt | Oilseed, Soybean | Imports | 3,100 | 2,800 | -300 | |

| India | Soybean Oil | Imports | 3,300 | 3,000 | -300 | |

| Indonesia | Plam Oil | Exports | 27,350 | 26,750 | -600 | |

| Iran | Soybean Meal | Imports | 1,400 | 1,600 | 200 | |

| Malaysia | Palm Oil | Imports | 1,000 | 800 | -200 | |

| Uruguay | Oilseed, Soybean | Exports | 2,400 | 2,800 | 400 | |

Sugar

Global sugar production is forecasted to reach 2.5 million tons in 2024-25 with higher production in China, India, Mexico, and Thailand, but lower production in Brazil. Consumption of sugar is also anticipated to rise to a new record with growth in markets such as India and Pakistan. Here is what global imports and exports of sugar have been forecasted in 2024-25.

Global imports of sugar is forecasted to get down to 989,000 tons, while exports may rise by 826,000 tons in 2024-25. India is expected to see higher imports of sugar to meet the rising local demand despite being one of the top sugar producers. Pakistan, Vietnam, and Indonesia are forecasted to record a decline in sugar imports. Brazil, the largest sugar producer, and exporter is expected to record an increase in the value of international shipments, while Mexico and India may see a decline in sugar exports.

Dairy Products

The global dairy products market size was valued at USD 511 billion in 2023 and is expected to hit USD 699 billion by 2033. According to a report, the North America dairy product market size was valued at USD 62 billion in 2023 and is expected to grow 2.9% from 2024 to 2033. Europe’s market size of dairy products was 135 billion in 2023 and is forecasted to grow 3% from 2024 to 2033. China and India will also see a growth of around 4% by 2033.

Cotton

Global cotton use is forecasted to reach 116 million bales in 2024-25. Greater cotton supplies and low global inventories of cotton textiles and products are expected to boost future use. The most pivotal factor favoring higher consumption in 2024-25 is the expected greater replenishment of inventories along the cotton supply chain.

Major Exporters of Cotton

| Trade Outlook | |||

| Previous | Current | Change | |

| World | 43,966 | 44,481 | 515 |

| Brazil | 11,700 | 12,100 | 400 |

| Syria | 75 | 200 | 125 |

Major Importers of Cotton

| Trade Outlook | |||

| Previous | Current | Change | |

| World | 43,936 | 43,978 | 42 |

| China | 14,200 | 14,800 | 600 |

| Pakistan | 3,000 | 2,800 | -200 |

| Bangladesh | 7,500 | 7,400 | -100 |

| Honduras | 125 | 225 | 100 |

| Turkey | 3,800 | 3,700 | -100 |

World Fruits Demand and Supply by Commodity

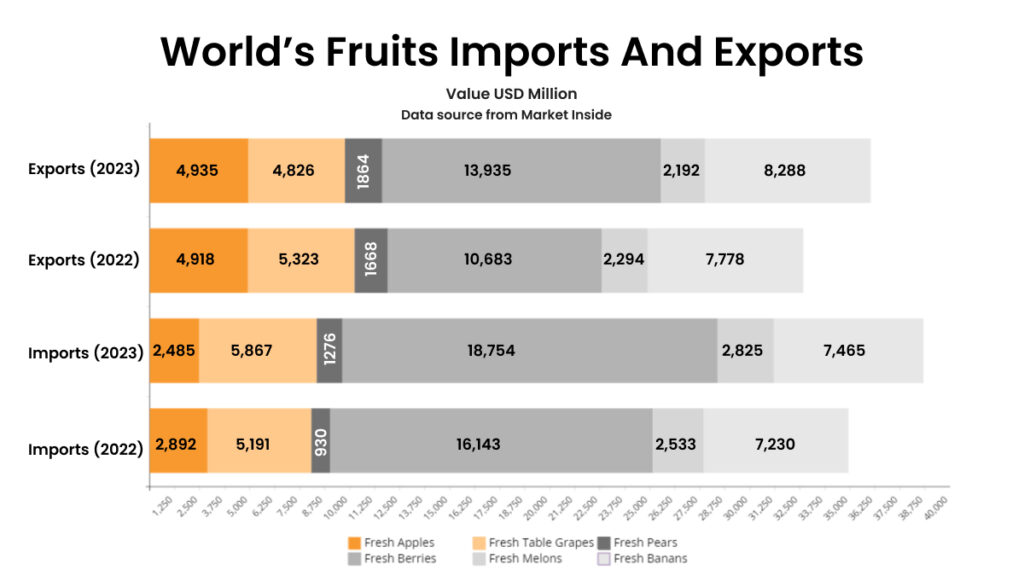

Global imports of fruits declined in 2023 as compared to the previous year, while exports increased with fresh berries recording the largest trade. In this research report, data from the following fresh fruits are analyzed to get the 2024 market outlook.

- Fresh Apples

- Fresh Table Grapes

- Fresh Pears

- Fresh Berries

- Fresh Melons

- Fresh Bananas

| Commodity | Imports (2022) | Imports (2023) | Exports (2022) | Exports (2023) |

| Fresh Apples | 2,892 | 2,485 | 4,918 | 4,935 |

| Fresh Table Grapes | 5,191 | 5,867 | 5,323 | 4,826 |

| Fresh Pears | 930 | 1276 | 1668 | 1864 |

| Fresh Berries | 16,143 | 18,754 | 10,683 | 13,935 |

| Fresh Melons | 2,533 | 2,825 | 2,294 | 2,192 |

| Fresh Banans | 7,230 | 7,465 | 7,778 | 8,288 |

*********Data of Top 5 Countries of Each Commodity: Germany, Indonesia, United Kingdom, Russia, Mexico, China, United States, Italy, South Africa, Chile, Netherlands, Peru, Indonesia, Belgium, Argentina, Canada, France, Spain, Brazil, Japan, and Russia.

Fresh Apples

Global apple production is forecasted to increase slightly to USD 83 million in 2024 as China, South Africa, and the United States are expected to gain and the European Union and Turkey to lose. Exports of fresh apples are estimated up to USD 6 million primarily on higher shipments from China, Iran, and the United States. Whereas, global imports of fresh apples are expected to come down by USD 5 million in 2024.

- India’s imports of fresh apples are expected to decline due to lower shipments from Iran and the European Union.

- European Union may also see reduced supplies from Chile and New Zealand.

- Brazil’s imports of fresh apples are forecasted to increase on higher shipments from the European Union and Argentina.

- Chile’s exports of fresh apples are forecasted to decline, while New Zealand may see an increase in the export shipments of fruit. South Africa is forecasted to rise in exports of fresh apples as damage from hailstorms was less than expected.

Fresh Table Grapes

Global production of table grapes for 2024 is forecasted to be USD 28.4 million due to improved China supplies. Exports are expected to remain nearly unchanged as greater shipments from China and Chile offset losses from Turkey and the United States. Imports of fresh table grapes are expected to be around USD 3 million, and exports are also forecasted to be around the same value.

- The European Union is expected to record a decline in imports of table grapes.

- Exports of table grapes from Chile are forecasted to go down in 2024, while India may see an increase in the value of export shipments of table grapes.

Fresh Pears

The production of fresh pears is predicted to increase to USD 25 million as gains in China more than offset weather-related losses in the European Union. Exports are forecasted to go up to USD 1.8 million on improved shipments from China and South Africa. Imports of fresh pears globally are expected to increase to USD 1.5 million in 2024.

- The European Union and Indonesia are expected to record a decline in imports of fresh pears in 2024.

- South Africa may see a decline in the value of export shipments of fresh pears.

Fresh Berries

The global fresh berries market is forecasted to reach USD 28 billion by 2023 from USD 22 billion in 2023, with a compound annual growth rate of 3% expected in 2024-2030. North America and Asia-Pacific are the biggest regions of trade of fresh berries. Europe, South America, and the Middle East are also major regions of imports and exports of fresh berries.

The global agricultural and fresh fruits market is witnessing steady growth, driven by increasing consumer awareness of health benefits, rising disposable incomes, and the demand for natural and organic food products.