China’s metal market is a wide, significant and dynamic industry in the world. The more China produce the base metals, the double it consumes, leaving way for not only exports of these commodities but also inviting imports from other countries.

Since the pandemic, countries, including China, are constantly putting efforts into rebounding their economy. However, the rising inflation rate and sluggish growth rate in production units have made it difficult for countries to produce enough volumes for bilateral trade and fulfilling consumer demand in the local market. Such is the case with China’s metal and its exports.

Base Metals Prices Declined

In the first quarter of 2023, the market prices of base metals such as aluminium and copper surged due to a possible recovery in China. However, in the second quarter, China’s economy did not make a robust recovery and the prices stifled thereafter.

According to the LME Market, base metals such as copper and lead prices declined more than 20 per cent, while aluminium and zinc declined substantially with a percentage of more than 50. This gives way to the rising prices of processing minerals and metals in other countries.

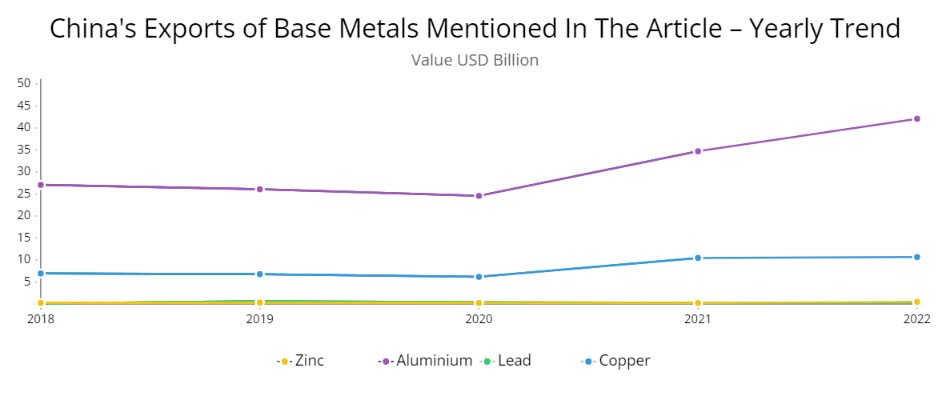

The below-represented China’s trade data shows the yearly values of the aforementioned base metals—copper, lead, aluminium, and zinc. As can be seen from the chart below, the exports of the featured metals went through fluctuations in 2019 and 2020 but peaked afterwards.

| China’s Exports of Base Metals Mentioned In The Article – Yearly Trend | ||||||

| Chapter | Metal | 2018 | 2019 | 2020 | 2021 | 2022 |

| 74 | Copper | 6.94 | 6.78 | 6.17 | 10.47 | 10.67 |

| 78 | Lead | 0.132 | 0.63 | 0.42 | 0.273 | 0.313 |

| 76 | Aluminium | 27.07 | 26.07 | 24.58 | 34.71 | 42.10 |

| 79 | Zinc | 0.249 | 0.331 | 0.242 | 0.223 | 0.490 |

| Value USD Billion | ||||||

Chip-Making Metals Restricted

The semiconductor industry is suffering after the pandemic, causing upheaval in global trade. The gradual fall in COVID-19 cases gave the green signal for a rebound in industries around the world. This ignited the demand to make use of a lot of chips and resulted in an eventual shortage.

In the first week of July, the Chinese government announced that they will restrict exports of some specific metals, named gallium and germanium. These metals are significantly used in making semiconductors, which can give rise to the already vigorous state of chip production.

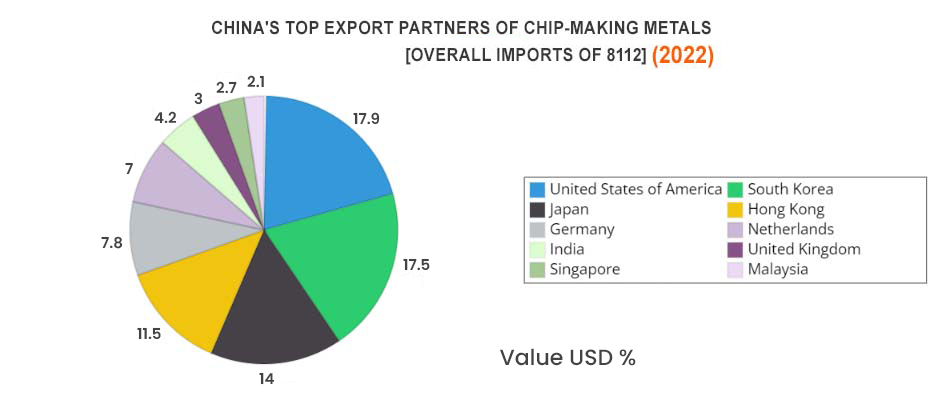

China’s export data reveal values for the exports of Heading 8112, which consist of base metals such as chromium, and thallium, and includes chip-making metals that China restricted exports of—gallium and germanium. China export data 2022 represented below is shown as per the availability.

China’s Metal Demand Growing

China’s domestic demand makes it a good opportunity for other countries to export their products to China. This turns upside down when China is locally producing the metals and regulating the supply chain within its own territories.

The export restriction on the metals from China doesn’t affect the countries relying on Asian country but also impact the exports of other countries for the metals they provide to China, so it can fulfil its domestic demand, especially in the manufacturing sector.

This is the reason many countries are developing their own base for producing metals and manufacturing. Specifically, the recent restrictions on the export of minor metals gallium and germanium have created waves in the US to shed its dependency on the Chinese economy.

GIPHY App Key not set. Please check settings