Iran and Israel enjoyed a good diplomatic and cooperative relationship, especially during the 1960s and 70s when both countries shared strategic and economic ties. However, this relationship was paralysed by the change in the political regime in Iran in 1979 with the Iranian Revolution.

In 2024, the Iran-Israel conflict deteriorated the country-to-country relation to a new low with Iran’s missile attacks on Israel. This escalated tension threatens global logistics and potential blockage of vital trade routes like the Red Sea and Suez Canal. This soaring freight rates and severe disruption to global supply chains. This blog will illuminate the potential disruption and the implications for export and import businesses.

How Does Iran-Israel Conflict Affect the Global Oil Supply?

Crude oil and petroleum products are the lifeline of the global economy. It’s the core of the power industries, transportation, and fuel economic activity. The vast dependency on crude oil and its products makes the globe heavily dependent on a steady supply, affecting export-import business from manufacturing to consumer costs.

What if the escalation becomes worse?

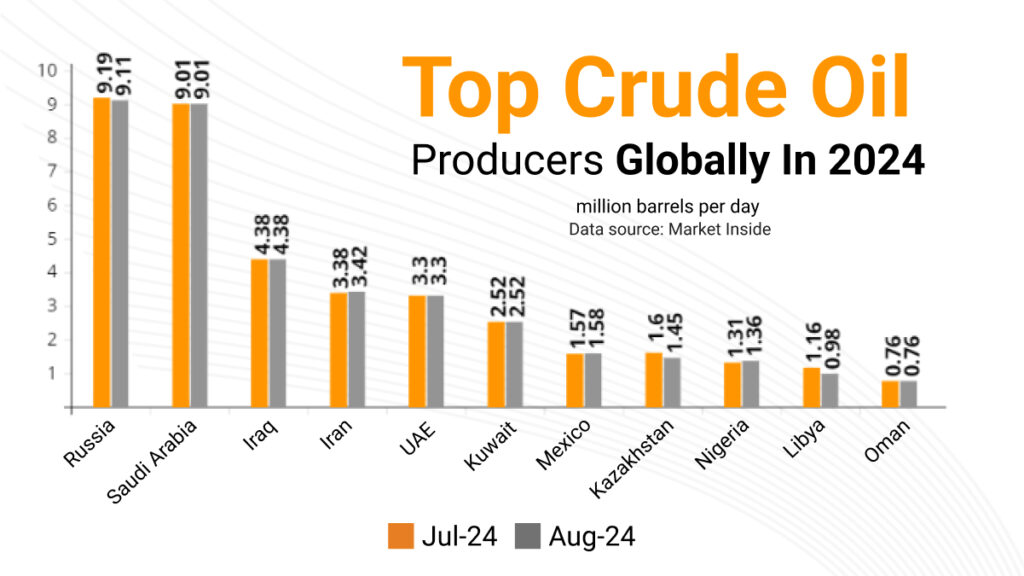

If the escalation between Iran and Israel takes an ugly turn, then the global oil market faces potential disruption. Iran is among the major crude oil producers with 3.42 million barrels per day (b/d) in August 2024, up from 3.38 million b/d in July 2024. On the other hand, Russia, Saudi Arabia, and Iraq are the top three suppliers with 9.19, 9.01, and 4.38 million b/d in August 2024. Under any circumstances these countries including Iran stop production or their ability to export oil through key routes like the Strait of Hormuz, the overall supply would be halted globally for a long, resulting in –

- Supply Chain disruption will result in a shortage of essential products, increased prices, and economic instability.

- Soaring transportation costs will make the goods costlier and slow down economic growth

- The rise in overall product cost resulted in a lack of consumer demand and supply of goods.

- Worsening of the Geo-political conflicts will attract trade barriers, sanctions, and the policy of favouritism.

| Top Crude Oil Producers in 2024 | Supply in Jul-24 | Supply in Aug-24 |

| Russia | 9.19 | 9.11 |

| Saudi Arabia | 9.01 | 9.01 |

| Iraq | 4.38 | 4.38 |

| Iran | 3.38 | 3.42 |

| UAE | 3.3 | 3.3 |

| Kuwait | 2.52 | 2.52 |

| Mexico | 1.57 | 1.58 |

| Kazakhstan | 1.6 | 1.45 |

| Nigeria | 1.31 | 1.36 |

| Libya | 1.16 | 0.98 |

| Oman | 0.76 | 0.76 |

What Are Major Oil Shipping Routes for Crude Oil and Petroleum Products?

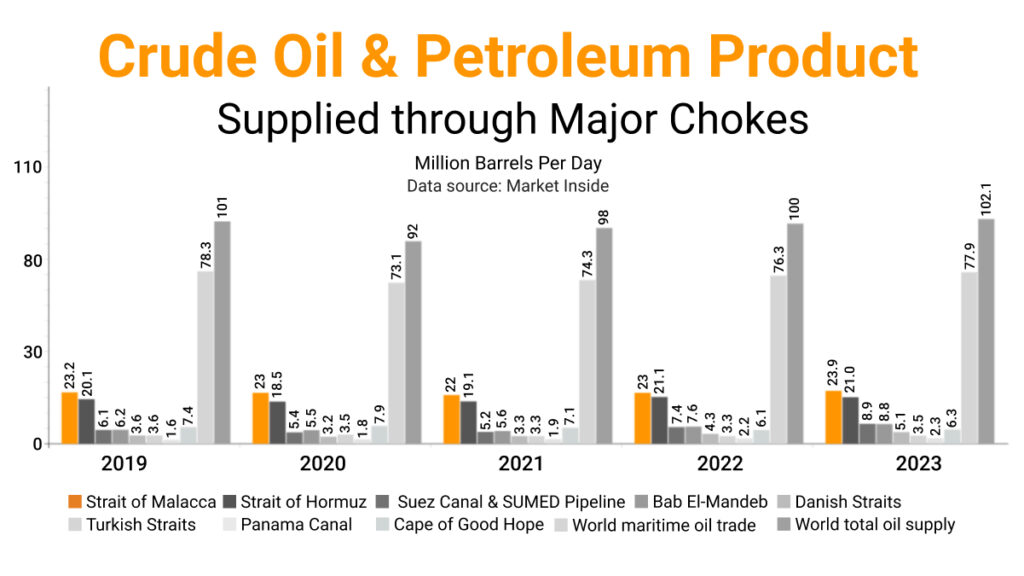

Since ancient times, the transportation of goods passed through the major choke points, a narrow passage of water. Today, the major choke points like the Strait of Hormuz, Bab el-Mandeb, and the Suez Canal are critical for global oil supply, handling millions of barrels per day. Blockages in these areas could reroute oil shipments, leading to delays, increased costs and economic strain for dependent countries, making security and accessibility vital for maintaining global oil trade stability. Let’s try to understand the volume of crude oil and petroleum supplied through major chokes

- The Strait of Malacca and Hormuz in the Pacific Ocean control half of the global crude oil and petroleum products with 23.7 and 20.9 million b/d, respectively in 2023.

- Oil passes through all major chokepoints significantly increased in 2023 except Strait of Hormuz which decreased by 0.2 million b/d.

- The world’s total oil supply stood at 102.1 million b/d in 2023.

- World maritime oil trade increased by 1.6 million b/d in 2023 compared to the previous year.

- In the last six years, the overall oil supply through the Cape of Good Hope decreased by 1.3 million b/d.

| World’s Major Transit Routes | 2019 | 2020 | 2021 | 2022 | 2023 |

| Strait of Malacca | 23.2 | 23 | 22 | 23 | 23.9 |

| Strait of Hormuz | 20.1 | 18.5 | 19.1 | 21.1 | 21.0 |

| Suez Canal & SUMED Pipeline | 6.1 | 5.4 | 5.2 | 7.4 | 8.9 |

| Bab El-Mandeb | 6.2 | 5.5 | 5.6 | 7.6 | 8.8 |

| Danish Straits | 3.6 | 3.2 | 3.3 | 4.3 | 5.1 |

| Turkish Straits | 3.6 | 3.5 | 3.3 | 3.3 | 3.5 |

| Panama Canal | 1.6 | 1.8 | 1.9 | 2.2 | 2.3 |

| Cape of Good Hope | 7.4 | 7.9 | 7.1 | 6.1 | 6.3 |

| World maritime oil trade | 78.3 | 73.1 | 74.3 | 76.3 | 77.9 |

| World total oil supply | 101 | 92 | 98 | 100 | 102.1 |

How Does the Iran-Israel Conflict in the Red Sea Area Increase Cargo Time and Freight Cost?

The Red Sea is strategically located in West Asia connecting Europe, South-East Asia, and Africa. This route is crucial for billions of dollars of goods consisting of oil, natural gas, and consumer products through the maritime route. However, some rising incidents of attacks in the region pose a significant threat to the global supply chain.

Attacks can double the transit times and freight costs. Let’s understand this –

- If a Cargo passes through Port Chiba in Japan to the US Gulf Coast via the Suez Canal, then it takes 40 to 44 days. However, if the cargo passes through the Cape of Good Hope, then shipping time would increase to 45-50 days.

- A ship usually takes 19 days to reach Rotterdam in Europe from the Arabian Sea in the Middle East via the Suez Canal. Surprisingly, these 19 days turn into 30-35 days as they pass through the Cape of Good Hope.

- In case of uncertainty, ships take the Cape of Good Hope route while using high sulfur bunker fuel (at 2023 level), then on average a ship is required to pay 30,000 to 40,000 dollars per day.

If the ongoing conflict is not stopped, the global economy may face a billion-dollar loss, affecting businesses, consumers, and economic activities. Hence, to protect the exporter’s and importer’s interests, govt across the world must come and find a solution.