The global economy has witnessed a sustained period of resilient growth as it enters the second half of 2024. Real GDP growth in advanced economies is expected to stay at 1.6% in 2024 and 1.7% in 2025, around the same level as in 2023. What is the export performance of top global economies? Let’s discuss and understand from this article.

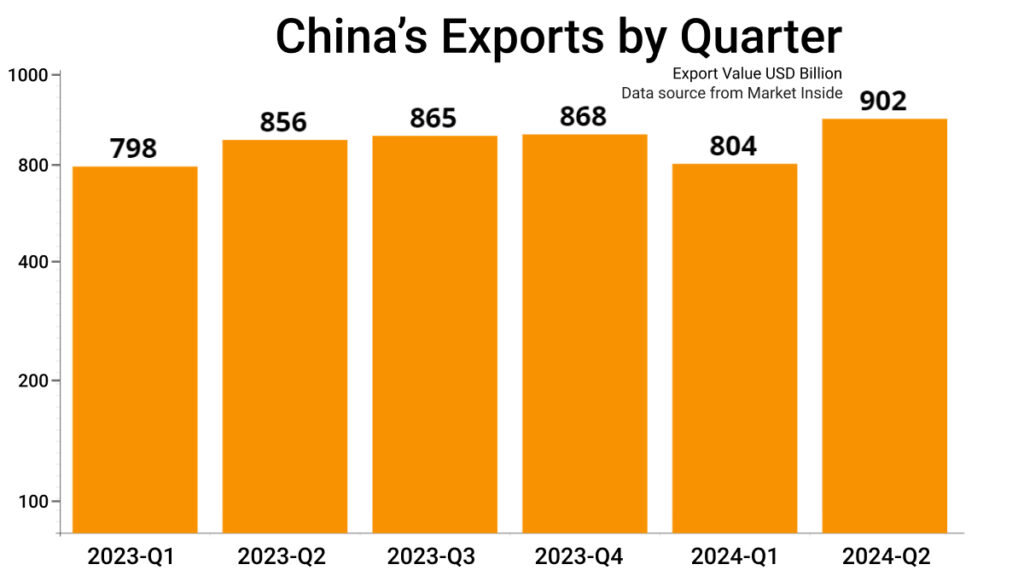

China

China’s exports increased to USD 902 billion in Q2 of 2024 from USD 804 billion in the first quarter. Here is a quarter-wise data analysis of China’s export market.

| Quarter | Export Value USD Billion |

| 2023-Q1 | 798 |

| 2023-Q2 | 856 |

| 2023-Q3 | 865 |

| 2023-Q4 | 868 |

| 2024-Q1 | 804 |

| 2024-Q2 | 902 |

List of Export Categories of China

| Export Category | 2024-Q1 (Value USD Billion) | 2024-Q2 (Value USD Billion) |

| Electrical Machinery and Equipment | 208 | 224 |

| Nuclear Reactors, Boilers, Machinery and Mechanical Appliances | 129 | 144 |

| Vehicles Other Than Railway or Tramway | 47 | 55 |

| Plastics and Articles | 33 | 36 |

| Furniture, Bedding, Mattresses, etc. | 29 | 33 |

| Articles of Iron and Steel | 23 | 25 |

| Organic Chemicals | 19 | 21 |

| Knitted or Crocheted Apparel and Clothing | 17 | 21 |

| Toys, Games and Sports Requisites | 15 | 20 |

| Optical, Photographic, Cinematographic, Medical Equipment | 16 | 18 |

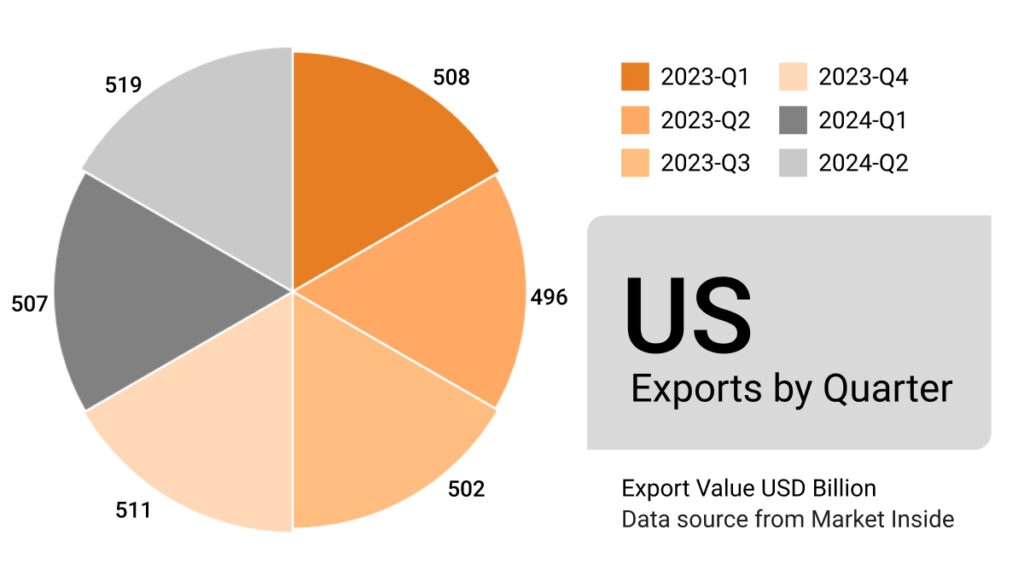

United States

In the United States, growth momentum was maintained in H1 2024, leading to a further upgrade in its real GDP growth forecast to 2.3% in 2024. However, a cooling labor market, persistent service price inflation, high consumer debts, and political uncertainty increasing around the upcoming November election. It may weigh on US economic growth during the second half of 2024 and 2025.

| Quarter | Export Value USD Billion |

| 2023-Q1 | 508 |

| 2023-Q2 | 496 |

| 2023-Q3 | 502 |

| 2023-Q4 | 511 |

| 2024-Q1 | 507 |

| 2024-Q2 | 519 |

List of Export Categories of United States

| Export Category | 2024-Q1 (Value USD Billion) | 2024-Q2 (Value USD Billion) |

| Mineral Fuels and Oils | 81 | 80 |

| Nuclear Reactors, Boilers, Machinery and Mechanical Appliances | 60 | 64 |

| Electrical Machinery and Equipment | 50 | 51 |

| Vehicles Other Than Railway or Tramway | 35 | 39 |

| Aircraft, Spacecraft and Parts | 30 | 32 |

| Optical, Photographic, Cinematographic, Medical Equipment | 26 | 27 |

| Pharmaceutical Products | 22 | 26 |

| Plastics and Articles | 20 | 20 |

| Pearls and Precious Stones and Metals | 21 | 17 |

| Organic Chemicals | 13 | 12 |

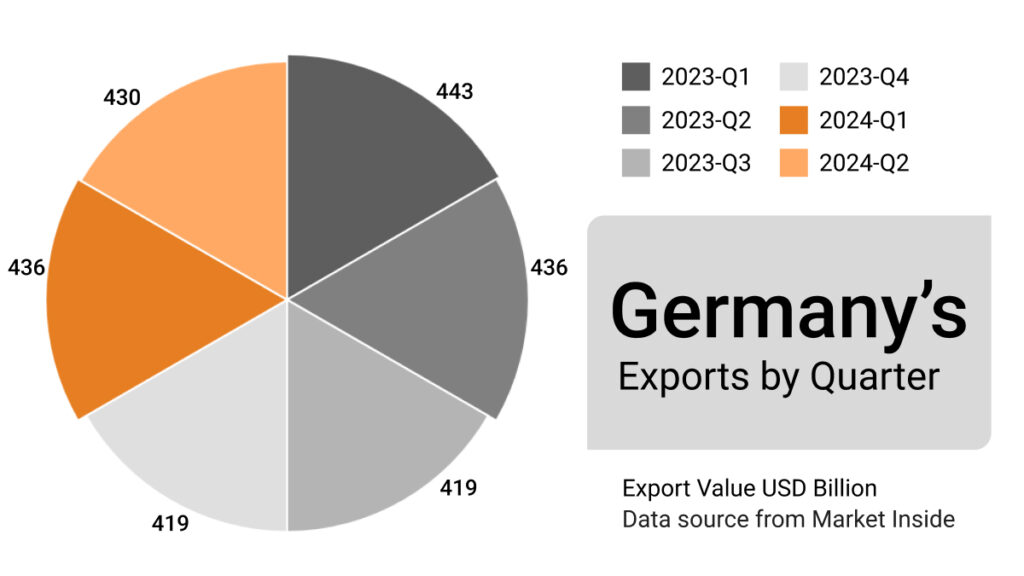

Germany

Germany is the third-largest country in exports globally and has reported fluctuations in the value of shipments in past quarters. According to German export data, Germany’s exports were slightly down to USD 430 billion in Q2 of 2024 from USD 436 billion in the first quarter of 2024.

| Quarter | Export Value USD Billion |

| 2023-Q1 | 443 |

| 2023-Q2 | 436 |

| 2023-Q3 | 419 |

| 2023-Q4 | 419 |

| 2024-Q1 | 436 |

| 2024-Q2 | 430 |

List of Export Categories of Germany

| Export Category | 2024-Q1 (Value USD Billion) | 2024-Q2 (Value USD Billion) |

| Vehicles Other Than Railway or Tramway | 74 | 74 |

| Nuclear Reactors, Boilers, Machinery and Mechanical Appliances | 70 | 68 |

| Electrical Machinery and Equipment | 46 | 45 |

| Pharmaceutical Products | 32 | 30 |

| Optical, Photographic, Cinematographic, Medical Equipment | 21 | 21 |

| Plastics and Articles | 18 | 18 |

| Articles of Iron and Steel | 9 | 9 |

| Miscellaneous Chemical Products | 9 | 9 |

| Mineral Fuels and Oils | 9 | 9 |

| Aircraft, Spacecraft and Parts | 7 | 8 |

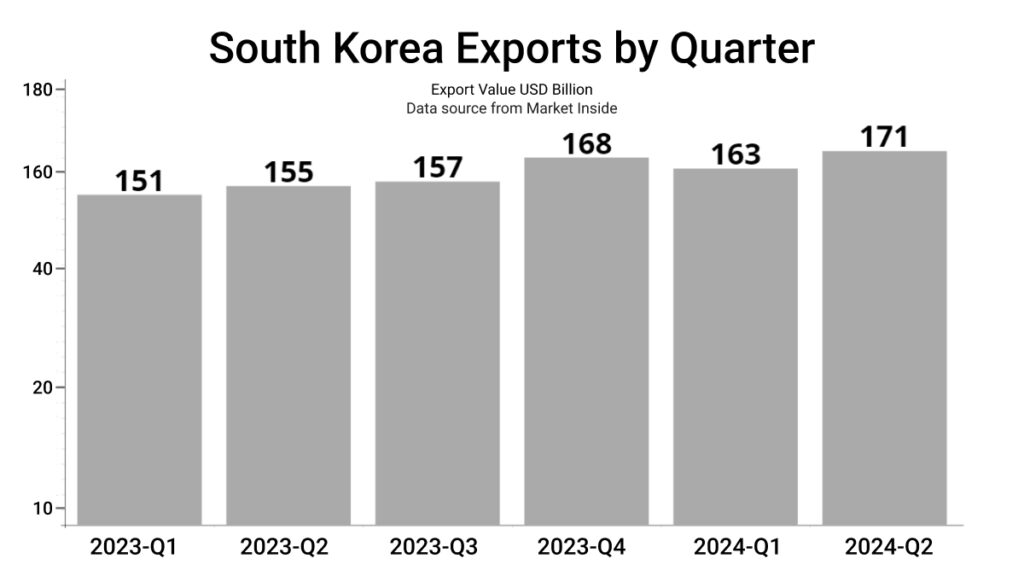

South Korea

South Korea reported an increase in the value of export shipments to USD 171 billion in Q2 of 2024 from USD 163 billion in the first quarter of 2024. Here are the quarter-wise values of South Korean exports.

| Quarter | Export Value USD Billion |

| 2023-Q1 | 151 |

| 2023-Q2 | 155 |

| 2023-Q3 | 157 |

| 2023-Q4 | 168 |

| 2024-Q1 | 163 |

| 2024-Q2 | 171 |

List of Export Categories of South Korea

| Export Category | 2024-Q1 (Value USD Billion) | 2024-Q2 (Value USD Billion) |

| Electrical Machinery and Equipment | 47 | 51 |

| Vehicles Other Than Railway or Tramway | 22 | 24 |

| Nuclear Reactors, Boilers, Machinery and Mechanical Appliances | 19 | 20 |

| Mineral Fuels and Oils | 14 | 13 |

| Plastics and Articles | 9 | 9 |

| Iron and Steel | 6 | 6 |

| Organic Chemicals | 5 | 5 |

| Ships, Boats and Floating Structures | 6 | 4 |

| Optical, Photographic, Cinematographic, Medical Equipment | 4 | 4 |

| Articles of Iron and Steel | 2 | 2 |

Japan

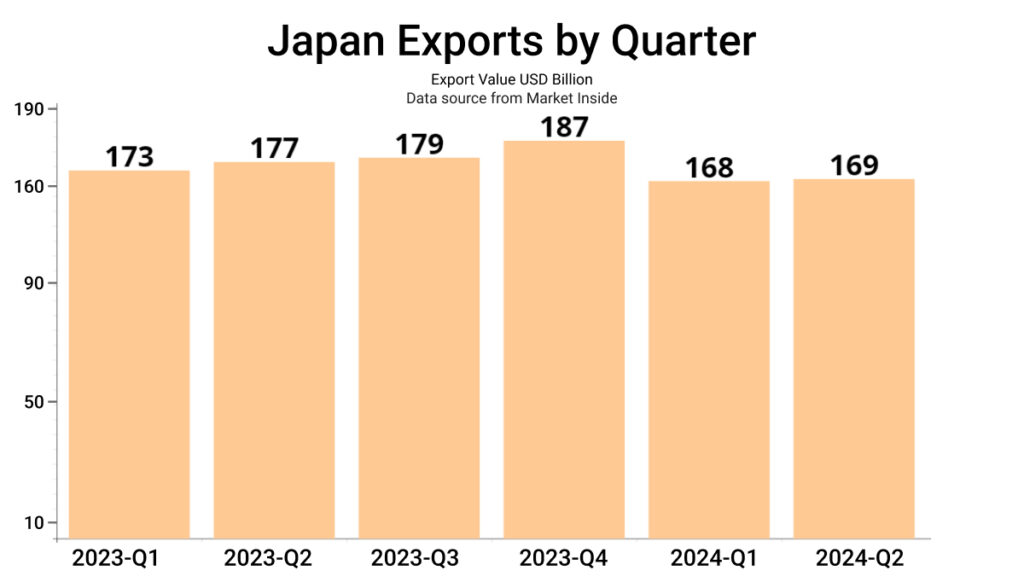

Japan also reported a slight rise in the export value of commodities in Q2 of 2024 from USD 168 billion in Q1 of 2024. This chart shows quarter-wise values of Japan’s exports to analyze the market.

| Quarter | Export Value USD Billion |

| 2023-Q1 | 173 |

| 2023-Q2 | 177 |

| 2023-Q3 | 179 |

| 2023-Q4 | 187 |

| 2024-Q1 | 168 |

| 2024-Q2 | 169 |

List of Export Categories of Japan

| Export Category | 2024-Q1 (Value USD Billion) | 2024-Q2 (Value USD Billion) |

| Vehicles Other Than Railway or Tramway | 35 | 36 |

| Nuclear Reactors, Boilers, Machinery and Mechanical Appliances | 30 | 30 |

| Electrical Machinery and Equipment | 23 | 23 |

| Optical, Photographic, Cinematographic, Medical Equipment | 8 | 8 |

| Iron and Steel | 6 | 6 |

| Plastics and Articles | 5 | 6 |

| Pearls and Precious Stones and Metals | 4 | 4 |

| Organic Chemicals | 3 | 3 |

| Copper and Articles | 3 | 3 |

| Miscellaneous Chemical Products | 3 | 3 |

The global disinflation process continues, but inflation is declining at a slower pace compared to 2023. Some price pressures are persistent, including those from the services sector and wage growth. In some emerging and developing countries, a strong US dollar adds pressure to the cost of energy, food, and other imported commodities.

Meanwhile, upside risks to inflation are increasing on the back of accelerating trade and geopolitical tensions, as well as growing policy uncertainty due to political upheavals in some parts of the world.

Growth prospects for the global economy continue to be surrounded by uncertainty and multiple downside risks. Global risks can come from three major factors:

- Rise of geopolitical conflicts including geoeconomic competition

- Existing macroeconomic headwinds

- Climate change impacts

With real GDP growth forecast to reach 4.2% in 2024 and 4.1% in 2025, emerging and developing economies will continue to outperform advanced countries. Growth predictions for China, India, and Brazil are revised slightly upward, reflecting the stronger economic activity in H1 2024, particularly in private consumption and exports.