Global supply chains have faced significant disruptions due to congestion caused by Red Sea diversions, resulting in soaring container rates, and creating challenges for businesses worldwide. Attacks by the Houthis on ships led to the United States and allied responses, causing chaos in maritime trade. India’s small and medium-sized businesses, especially exporters, are bearing the worst hit. Let’s closely analyze the export traffic of India’s top ports and destinations and examine the main problems for exporters.

According to a report, small and medium-sized business (SMB) shippers began increasing their trade activity earlier than usual. The motivations behind this early surge included:

- Avoiding potential delays or high rates later in the year due to the Red Sea crisis.

- Bringing in commodities ahead of new tariffs.

- Preventing disruptions from potential East Coast labor strikes.

Higher ocean freight costs have forced SMB retailers to adjust their pricing strategies. Many businesses have shifted some of their goods to air cargo to mitigate the impact of ocean logistics disruptions.

Logistics operations disrupted

Logistics costs seriously affect the country’s manufacturing sector, global positioning, and export competitiveness. The Red Sea route, which is shorter and faster, was the preferred choice for most shipping companies. For instance, carriers from major Indian ports like Mumbai and JNPT navigated through the Suez Canal into the Mediterranean Sea to reach various European ports depending on their destination.

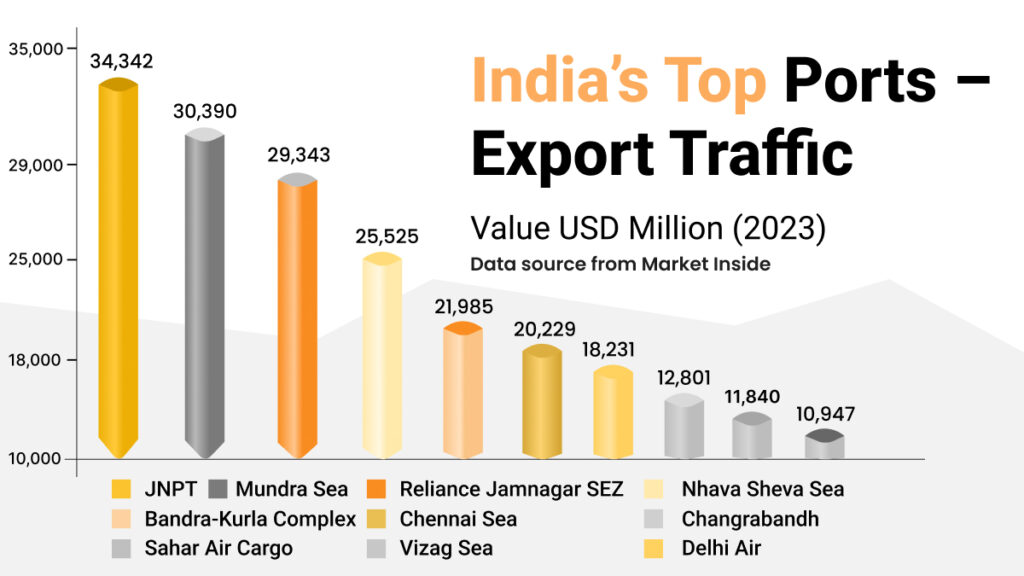

| Port of Loading | Value USD Million (2023) | Value USD (Jan-Jul 2024) |

| JNPT | 34,342 | – |

| Mundra Sea | 30,390 | 19,083 |

| Reliance Jamnagar SEZ | 29,343 | 13,085 |

| Nhava Sheva Sea | 25,525 | 40,309 |

| Bandra-Kurla Complex | 21,985 | 10,934 |

| Chennai Sea | 20,229 | 7,870 |

| Delhi Air | 18,231 | 10,831 |

| Changrabandh | 12,801 | – |

| Sahar Air Cargo | 11,840 | 7,235 |

| Vizag Sea | 10,947 | 5,707 |

India export data shows that India shipped goods worth USD 431,418 million to the world in 2023, in which USD 96,366 million shipments went to European countries. Below given chart shows the values of India’s exports to the world, Europe, and European countries.

| India Exports | Value USD Million (2023) | Value USD Million (Jan-Mar 2024) |

| World | 431,418 | 120,443 |

| Europe | 96,366 | 27,161 |

| Netherlands | 23,111 | 6,774 |

| United Kingdom | 13,401 | 3,489 |

| Germany | 9,668 | 2,710 |

| Italy | 8,404 | 2,639 |

| Belgium | 7,975 | 1,992 |

| France | 7,188 | 1,906 |

| Spain | 4,625 | 1,393 |

| Russia | 4,056 | 1,151 |

| Poland | 2,322 | 683 |

| Romania | 1,649 | 277 |

India was heavily reliant on this route for trade and energy imports and due to the disruptions; exporters here now must diversify their trade routes. Major shipping companies have increased their costs which is hitting the Indian companies very hard. Disruption in freight services consequent to the deluge and almost a 50% increase in air freight charges have affected the export of perishable goods like eggs, fruits, flowers, and vegetables to the US, UK, and among other parts of the world.

The disrupted shipping and its implications

As a major route enabling nearly 30% of the world’s container traffic, the Red Sea shipping crisis has churned out some serious disruptions.

- Environmental Impact: With the substantial increase in journey duration, the GHG (Greenhouse Gas) levels will see an estimated increase of 31% to 66%.

- Inflation: With the movement of shipping rerouted, the longer-distance fairway has seen a rise of about 50% setting the base for more fuel consumption and increased financial requirements.

- The Decline in Traffic: According to a report, there was a record decline of 50% in traffic by March 2024 due to the Red Sea crisis. Directly impacting the local economy, SMEs, suppliers, and companies, the port calls have reduced by 6% based on last year’s baseline.

- Commodity Price Increase: With the surge in commodity prices, the estimated global inflation is projected to be 0.07% over the next 12 months.

- Shipment Delay: Regular attacks by Houthi rebels forced shipping via Africa, resulting in an average rise in the delivery timeline by 10 days.

The impact on industries and markets

- Automotive industry: The most impacted of all industries was automotive. With the implementation of their “just in time” manufacturing principles, global automotive manufacturers had to halt their production in Europe due to delivery delays.

- Inventory Lessons: On the back of the global pandemic, organizations imparted their crucial learnings of keeping safety stock during the ongoing Red Sea crisis.

Despite the current challenges, Red Sea disruptions could not be as severe as those experienced during the pandemic. The anticipated easing of demand and congestion should help mitigate some of the challenges. As small and medium-sized businesses adapt to the current landscape, monitoring these trends will be crucial for navigating the evolving global freight market.