In a recent geopolitical event, Iran shocked the world with potential disruption in worldwide oil supply by blocking the strait of Hormuz. This strategic place controls around 30% of the global oil supply and 20% of natural gas exports to the world, passing through this strait.

The Strait of Hormuz is one of the biggest oil and natural gas reserves in the world. Due to its strategic location, any disruption to this strait may affect the worldwide supply of goods and oil. Discover how important the Strait of Hormuz is.

Will the Strait of Hormuz Get Blocked?

Whether this bottleneck of the global supply will be blocked or not, can be predicted. However, the potential disruption to worldwide supply chains and the rise in the price can be predicted. Here, this market Inside research, crafted data and predicts the market trend.

Iran, the most important country in the Middle East, warned the world to close the strait of Hormuz, which is known as the artillery of the world’s oil. In any scenario, if the strait is blocked, then there could be a shortage of approximately 30% of the global supply.

From Jan to Oct 2023, around 16 mb/d of crude oil passed through SoH, which is nearly 40% of the global supply. If categorized by country, then in Asia, India and China import more than 30% of crude oil supply from the Strait of Hormuz. On the other hand, Japan and Korea are more dependent on the Gulf region for their Oil needs.

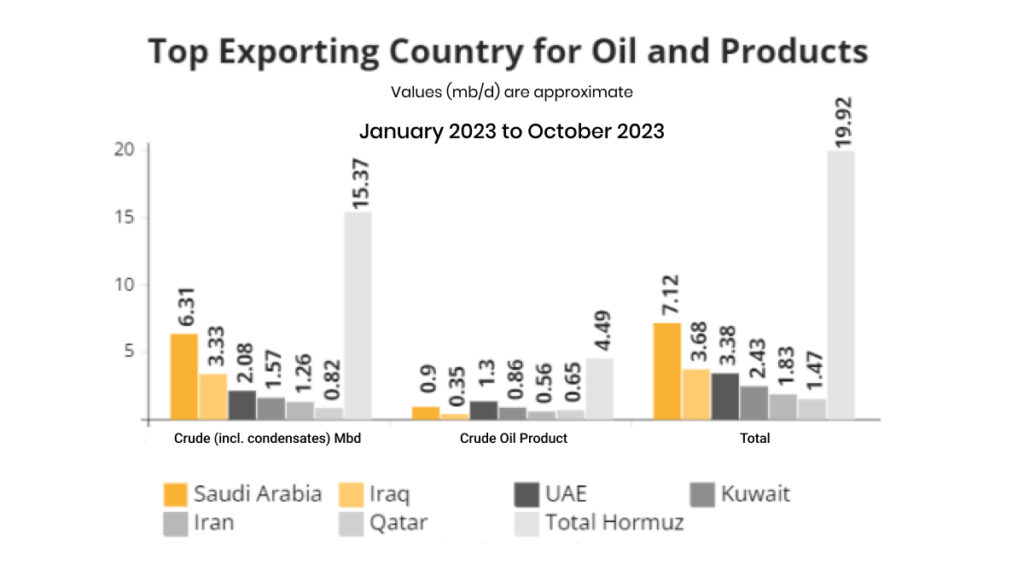

Top Oil Exporters from the Strait of Hormuz

- From January 2023 to October 2023, the export of crude oil and products made of it stood at 19.92 mb/d, which is around 1/3rd of world oil supply.

- Saudi Arabia, Iraq, UAE, Kuwait, Iran and Qatar are the key suppliers of Crude Oil to the world.

- Saudi exports of crude oil and products remained at the top position with 7.12 mb/d

- UAE exports 1.3 mb/d of petroleum products from SoH which is around 30.7% more than Saudi Arabia.

- China, India, and Japan are the largest importing countries for oils and products from SoH.

- Crude oil is the main exported commodity in comparison to its products. (Check the table No -1)

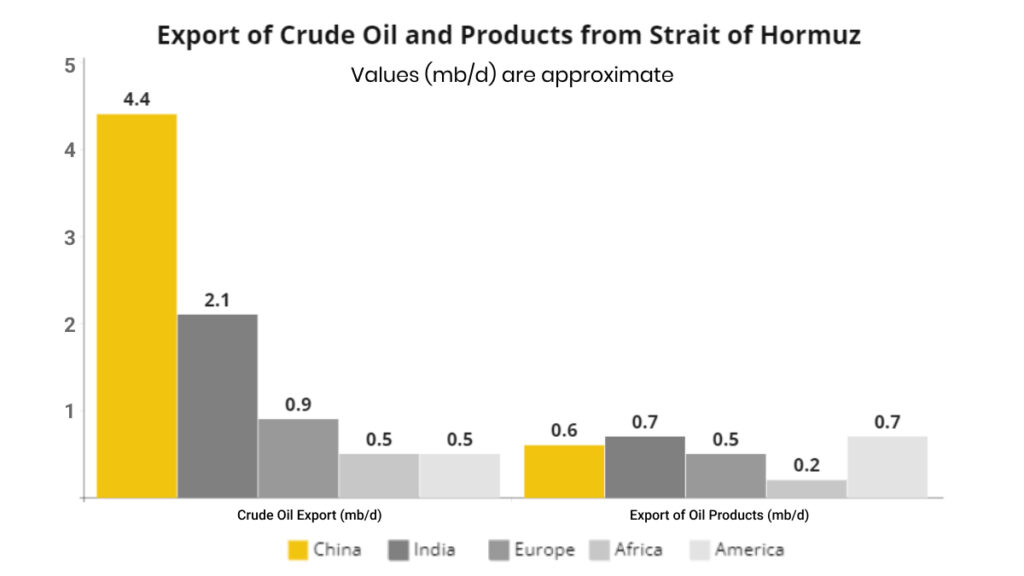

Top Importers for Crude Oils and Products from Strait Of Hormuz

Till now we have discussed the top exporters for Oils and Products. Now, understand the top importers along with the market trend.

- If analyzing the data, China and India became the biggest importer of Crude oil and products. This shows both are heavily dependent on the Strait of Hormuz for their energy needs.

- Exports of Oil products from SoH are more to India than China. However, for crude oil import China surpasses India.

- Europe’s demand for Crude oil is 111% more than the demand for petroleum products.

- America is the only country whose import of Crude Oil is less than 40% less than the import of Petroleum products.

- In the case of blocking the Strait of Hormuz, China and the Indian economy would be badly hit with supplies, causing an increase in the price of essential commodities. (For detailed data, check Table No. 2)

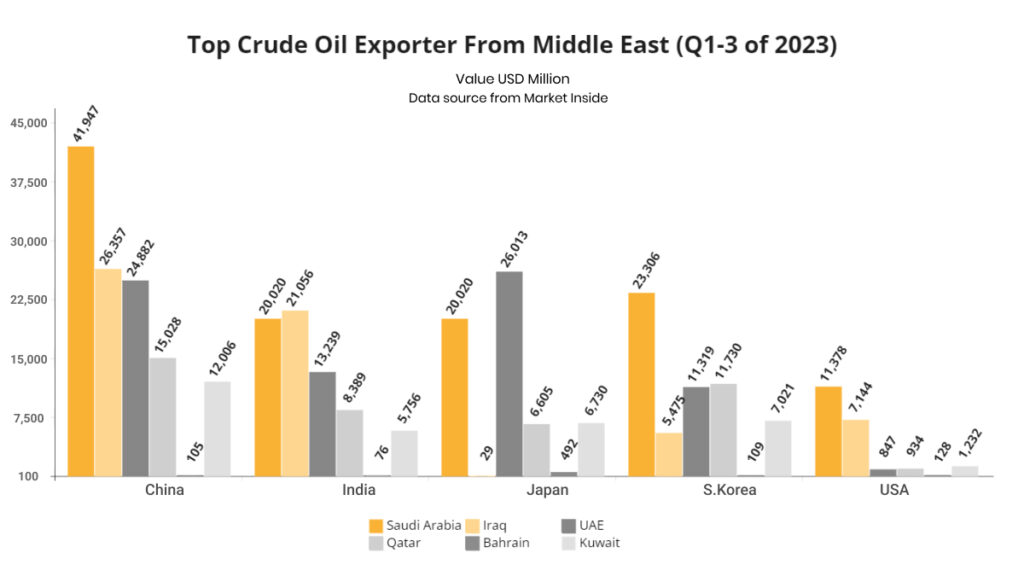

Strait of Hormuz: An Important Route for Trade

Curious to know about the total trade value along with the top importers and exporters of crude oil? Let’s understand this from the trade value Q1 to Q3 of 2023.

- From Middle Eastern countries, Saudi Arabia is the biggest exporter of oil and China became the largest importer with $41.9 billion in 2023 (till Q3).

- Japan’s import of crude oil from Iraq is the lowest with $29 million, and the highest is UAE with $26 billion.

- Japan imports $492 million worth of crude oil from Bahrain in 2023 (till Q3), and becomes the largest trading partner for Bahrain.

- South Korea imports its majority of Oil from Saudi Arabia, UAE, and Qatar worth $23.3, $11.3, and $11.7 billion, respectively, in 2023 (Till Q3).

- The USA imports the majority of its oil from Saudi Arabia and Iraq which is valued at $11.3 and $7.1, respectively, in 2023 (till Q3). (Check Table No. -3)

Top LNG importers From the Strait of Hormuz

Liquified natural gas (LNG), plays an important role in the global energy market as an alternative source of fuel. Around 25% and 13% of Asia and the EU’s demand for LNG is met through the Strait of Hormuz. Here are some points that present the importance of SoH for LNG –

- UAE and Qatar are the largest exporters of LNG via SoH

- Qatar is the world’s 2nd largest exporter of LNG with 90 billion cubic meters (bcm) in the first 10 months of 2023, whereas UAE exported 5.5 bcm.

- Around 19.8% of the global supply of LNG is transited through this route.

- Around 80% of the total volume of LNG exports went to Asian markets, and 20% was exported to the EU.

- China, India, and South Korea import more than 50% of their LNG demand from the Strait of Hormuz.

*These are the Approximate percentage of value.

How the Global Economy Would Affect If SoH is Closed

1. Increase In Oil Price –

If the tension between Iran and Israel escalates, the price of Brent crude oil may cross the $100 per barrel. This may cause a major supply shortage, as SoH controls around 30% of the global supply.

2. Global Recession –

The increasing price of Oil and Gas would bring a ripple effect globally. Exporters and importers have to pay extra for the transportation of goods, leading to a decline in demand and supply.

3. Disruption in Worldwide Supply Chain –

The oil and gas industry are like a web of industrial networks that depend on each other for their supply networks. Any attempt to block the strait makes export and import harder than ever.

4. Impact on Developing Nation –

In case of blockage of the Strait, developing countries will find it difficult to meet their energy demand. High Oil prices, a decline in their exports, and economic activities will push the country into a recession.

5. Devaluation of Currencies –

A higher price of oil can create a scenario where the currency of a nation starts losing its value, for instance, higher import costs lead to a trade deficit, reducing purchasing power and decreasing demand and supply.

The Strait of Hormuz is one of the important sites that ensure the global supply of oil and gas across the world, which further ensures a sustainable supply network globally. Thus, it becomes crucial for the world Govt to secure the route for lasting business growth.

Table No 1

| Countries | January 2023 to October 2023 | ||

| Crude (incl. condensates) Mbd | Crude Oil Product | Total | |

| Saudi Arabia | 6.31 | 0.9 | 7.12 |

| Iraq | 3.33 | 0.35 | 3.68 |

| UAE | 2.08 | 1.3 | 3.38 |

| Kuwait | 1.57 | 0.86 | 2.43 |

| Iran | 1.26 | 0.56 | 1.83 |

| Qatar | 0.82 | 0.65 | 1.47 |

| Total Hormuz | 15.37 | 4.49 | 19.92 |

***Values (mb/d) are approximate

Table No 2

| Countries | Crude Oil Export (mb/d) | Export of Oil Products (mb/d) |

| China | 4.4 | 0.6 |

| India | 2.1 | 0.7 |

| Europe | 0.9 | 0.5 |

| Africa | 0.5 | 0.2 |

| America | 0.5 | 0.7 |

***Values (mb/d) are approximate***

Table No 3

| Exporters | China | India | Japan | S. Korea | USA |

| Saudi Arabia | 41947 | 20020 | 20020 | 23306 | 11378 |

| Iraq | 26357 | 21056 | 29 | 5475 | 7144 |

| UAE | 24882 | 13239 | 26013 | 11319 | 847 |

| Qatar | 15028 | 8389 | 6605 | 11730 | 934 |

| Bahrain | 105 | 76 | 492 | 109 | 128 |

| Kuwait | 12006 | 5756 | 6730 | 7021 | 1232 |

****Value USD Million****