The global packaging industry is a broad sector that indulges different industries as its part. The scope of the global industry for packaging ranges from F&B to e-commerce, comprising the most significant number of industries and their respective requirements for products manufactured.

The packaging industry is composed of different packaging materials and types, and depending on the kind of packaging, any particular industry is demanding for their product to be packaged and distributed in the market for consumers. In the past few years, the industry has witnessed a surge in its demand for packaging products and will witness further elevation.

Global Packaging Industry – An Outlook

From packaging consumer staples to packaging machinery, the packaging industry is a significant one and is often interlinked with other industries such as food and beverage, and manufacturing to pack materials. Other industries that are dependent on the packaging industry include pharmaceuticals, cosmetics and more.

The global packaging industry is a robust sector with different materials falling under its dimensions. The packaging industry does not define the use of plastic only but also comprises other materials such as glass, metal, paper, and a combination of these known as flexible packaging. The packaging products include containers, jars, pouches, films & sheets, etc.

The representation of global trade data for packaging materials has been shown on a yearly basis. The materials are shown on the bifurcation of HS Code classification, taking into account the respective Headings for each material. The shown data features these materials for a wide range of products comprised within the Headings of each material:

- Flexible Packaging – 3921 Heading

- Plastic Packaging – 3923 Heading

- Paper Packaging – 4819 Heading

- Metal Packaging – 7310 Heading

- Glass Packaging – 7010 Heading

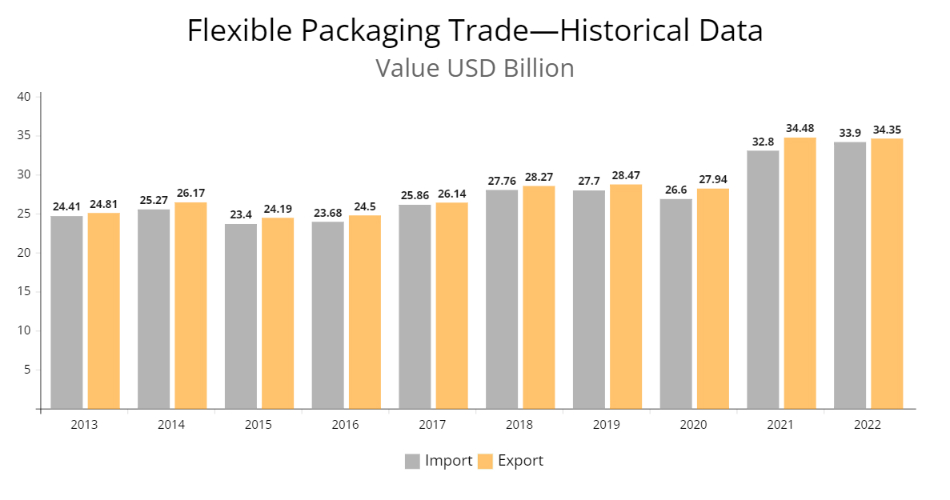

Flexible Packaging – Global Imports & Exports

The flexible packaging industry is the most widespread kind of packaging present in the world and comprises metals, glass and paper with plastic. With growing consumer demand for better packaging, flexible packaging is used in making ziplock pouches, laminated tubes and more. 2022 registered the highest surge in imports by $33.9 billion and $34.3 billion in exports.

The top importing countries for flexible packaging materials in 2022 are—the US ($2.2 billion), France ($1.7 billion), Italy ($1 billion), Spain ($831.89 million), and Belgium ($661.80 million). The top exporting countries for the same year in flexible packaging are—China ($3.1 billion), Germany ($1.6 billion), Italy ($1.2 billion), France ($924.96 million), and Mexico ($743.89 million).

Plastic Packaging – Global Imports & Exports

Plastic packaging is the most common and widespread due to the lower cost and easy availability of polymers for manufacturing. The global trade data, as shown below, reveals the yearly import-export values, providing insights into plastic packaging and its materials. The highest surge was registered in 2022 for $67.7 billion in imports and $71.3 billion in exports.

The top importing countries for plastic packaging in 2022 are—the US ($10.8 billion), Germany ($4.4 billion), Mexico ($3.6 billion), France ($3.5 billion), and Canada ($3.1 billion). The top exporting countries for plastic packaging in the same year were—China ($15.1 billion), the US ($6.6 billion), Germany ($5.7 billion), Mexico ($2.9 billion), and France ($2.8 billion).

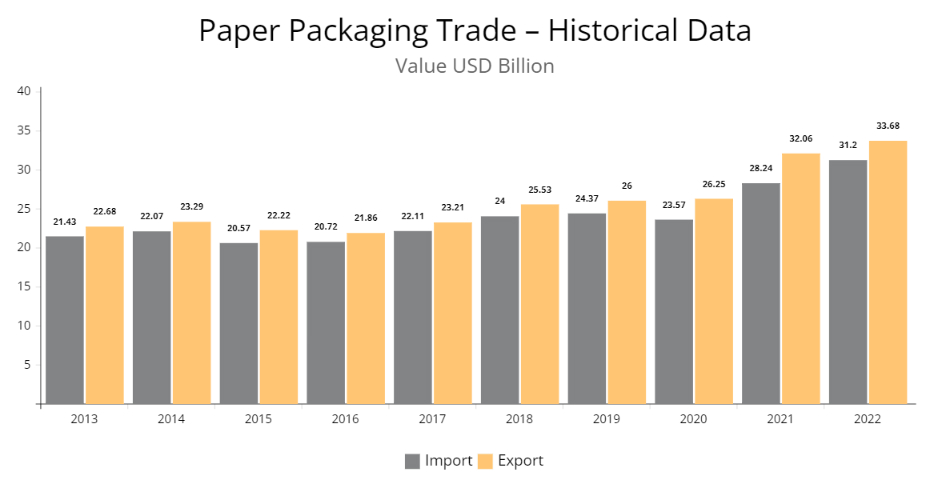

Paper Packaging – Global Imports & Exports

A more biodegradable option and an alternative to plastic packaging, paper packaging is among the rapidly growing packaging forms. As shown in the global trade data for paper packaging below, the yearly values feature the yearly import and export values. The highest surge is registered in 2022 with a value of $31.2 billion for imports and $33.6 billion for exports.

The top importing countries for paper packaging in 2022 are—the US ($3.8 billion), France ($2.5 billion), Germany ($2 billion), the Netherlands ($1.7 billion), and the UK ($1.3 billion). The top exporting countries for the same year in paper packaging are—China ($7.7 billion), Germany ($3.9 billion), the US ($2.4 billion), Italy ($1.8 billion), and Poland ($1.6 billion).

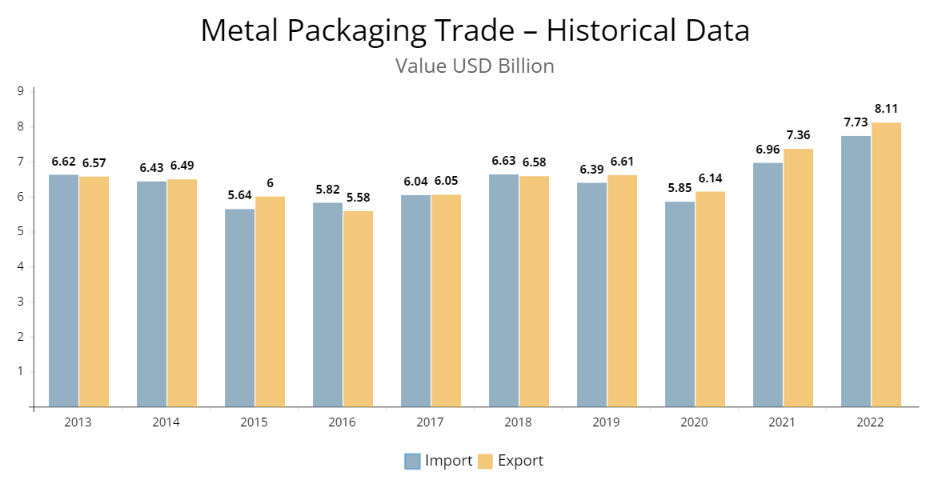

Metal Packaging – Global Imports & Exports

A fairly narrow but widely used in the form of containers or foils for food and beverages, metal packaging is among the most eco-friendly options. As per the global trade data below, the yearly import-export values are featured for the metal packaging trade. The highest surge for the trade of metal packaging was recorded for $7.7 billion in imports and $8.1 billion in exports in 2022.

The top importing countries for metal packaging in 2022 are—the US ($586.19 million), France ($576.48 million), Germany ($538.76 million), Belgium ($519.98 million), and Canada ($496.10 million). The top exporting countries for metal packaging in 2022 are—China ($1.5 billion), the US ($835.03 million), Germany ($718.92 million), Italy ($536.65 million), and Spain ($448.49 million).

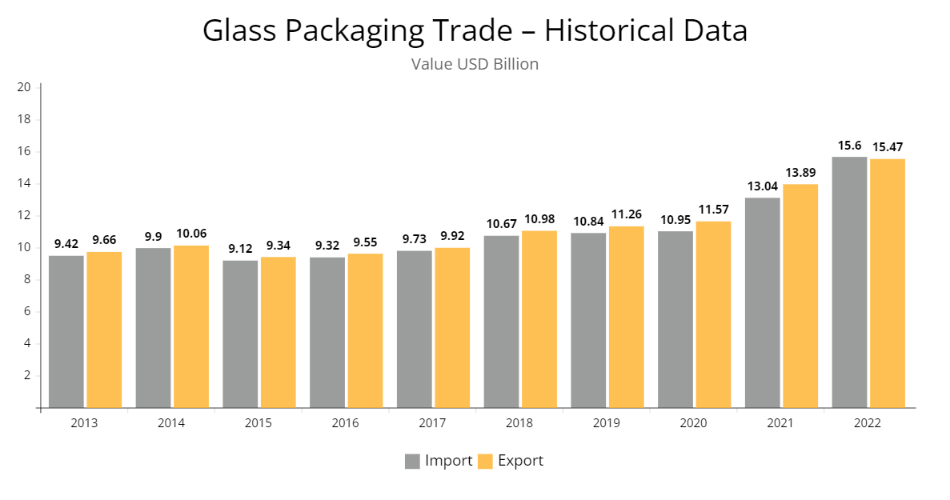

Glass Packaging – Global Imports & Exports

The scope of the industry has been limited to chemical or pharmaceutical, however, now food and beverage, along with cosmetics, have also become a part of the glass packaging. According to the shown global trade data, the yearly values are featured for both import & export. 2022 registered the highest growth, with $15.6 billion in imports and $15.4 billion in exports.

The top importing countries for glass packaging materials in 2022 are—the US ($2.2 billion), France ($1.7 billion), Italy ($1 billion), Spain ($831.89 million), and Belgium ($661.80 million). The top exporting countries for glass packaging in 2022 are—China ($3.1 billion), Germany ($1.6 billion), Italy ($1.2 billion), France ($924.96 million), and Mexico ($743.89 million).

Current Trend and Future Projections

Global packaging is growing with the consumer demand for a better quality of packaging consumer staples, ready-to-eat food items, and pharmaceuticals since COVID-19, and increasing quality of life. The sector of food and beverage contributes the highest value to the global packaging industry, followed by pharmaceuticals and others.

The reason the packaging industry has been consistent in terms of production is due to its application. The market size of the global packaging industry is growing at a rapid pace, especially in the aftermath of the COVID-19 pandemic. The global packaging industry is valued at $1.10 trillion in 2023 and is expected to stand at $1.33 trillion by 2028 with a 3.9% CAGR.